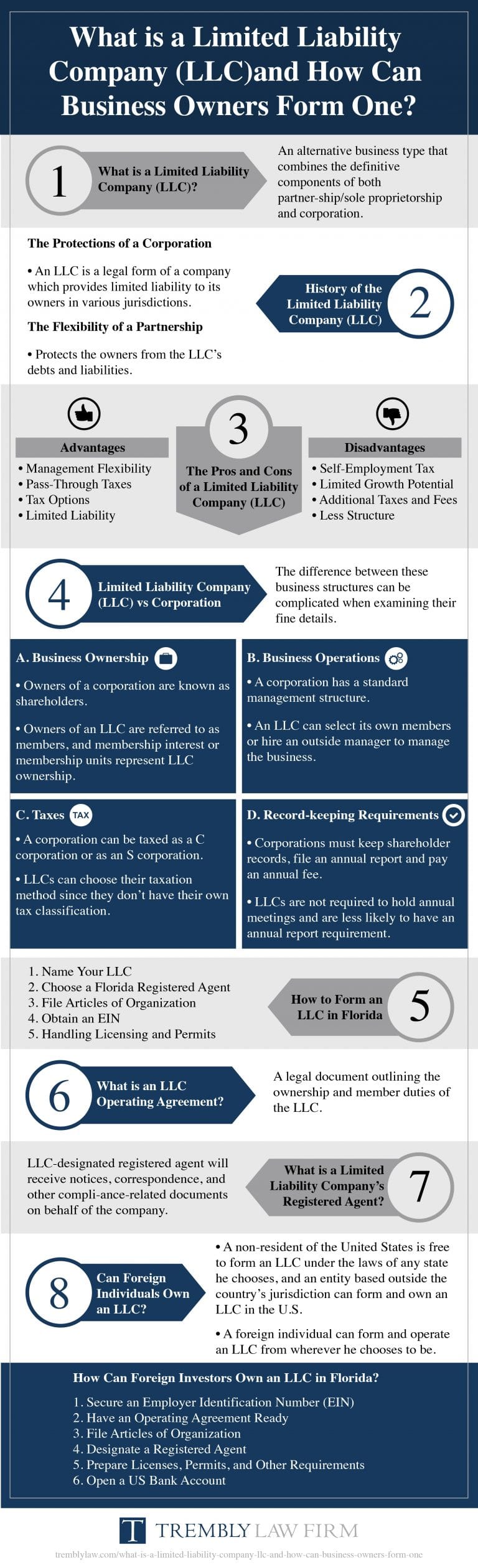

Finding the right business option is the most challenging part for aspiring entrepreneurs because each business form has its own unique positive attributes and legal protections. Nowadays, the most popular type of business venture is the Limited Liability Company (LLC). In this article, we will talk about the ins and outs of this revolutionary way of doing business.

What sets apart an LLC from a partnership is that it separates the company’s business assets from its owner’s personal assets. This corporate structure protects the owners from the LLC’s debts and liabilities. That means members can’t be held personally liable for any incurred company debts or liabilities. Consequently, an LLC functions similarly to a partnership since the company’s profits pass through to owners’ tax return, which means that LLCs only files for informal tax return.

As time passed, the landscape of business forms also changed. Before, the only choices for business entities were sole proprietorship, partnership, and corporation. However, in 1977, the Wyoming legislature introduced a little-known business entity that would later revolutionize how America conducts business.

LLC was born out of the conflict between the Internal Revenue Service (IRS) and the needs of business owners. The first established LLC Act was the result of well-thought-out plans designed by several accountant and lawyers who worked for Hamilton Brothers Oil Company. However, the federal government was reluctant to grant the entity with partnership tax treatment.

In 1980, the IRS issued its first ruling. It stated that any entity providing limited liability protections would be taxed as a corporation. This ruling was not well-received especially by high-powered law firms who were concerned about its effect on entities such as trusts. This reaction prompted the withdrawal of the proposed regulations. It wasn’t until 11 years later, on September 2, 1988, that the IRS finally issued a ruling which states that LLC will be taxed as a partnership and afford limited liability protections to LLC members.

In 1982, Florida had its own LLC statute. However, because of the state’s established corporate income tax on LLCs, it wasn’t widely used until 1998. In the succeeding years, the state’s LLC Act undergo various revisions and clean-up to be more effective for limited liabilities companies in Florida.

The LLC has definitely grown to become one of the most popular business forms in the United States. However, like any business venture, LLC has its advantages and disadvantages.

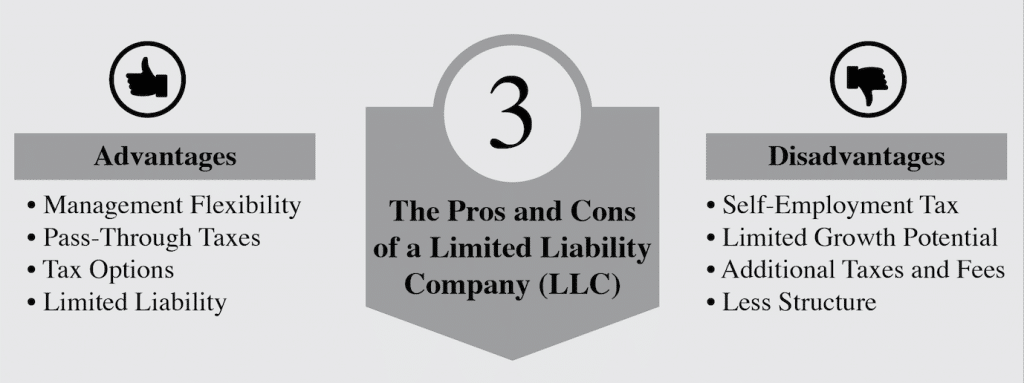

An LLC might have certain things to fulfill, but it still has a more flexible management structure. It can be tailored to the business owner’s requirements. Additionally, members can choose to manage it which allows all owners to take part in the business’ decision-making. Moreover, owners have the option of hiring managers who can either be members or outsiders. This business structure is helpful for business owners who don’t have first-hand experience in running a business. However, most states require an LLC to be member-managed unless clearly stated in filings with the secretary of the state or equivalent agency.

An LLC is a pass-through entity which means there is no need to file a corporate tax return. Since the profits go directly to its members, it is taxed on members’ federal income tax returns and not on the company level which makes filing taxes easier. Moreover, if the business loses money, then the members can shoulder the hit on their returns and lower their tax burdens.

An LLC can opt whether to be taxed as a sole proprietorship, partnership, S corporation or C corporation as long as they would qualify for such tax treatment. This provides a great deal of flexibility.

As its name suggests, an LLC protects its members from some or all liabilities if the company faces debt or any legal issues as long as they did not personally guarantee. This only means that members’ personal assets are protected in case the LLC is sued or becomes bankrupt.

An LLC requires much less administrative paperwork and fees. With less paperwork, there’s less record-keeping required as well. There’s also no need for an annual meeting as an LLC isn’t required to have a board of directors.

The LLC’s operating agreement can help decide how ownership interests are sold or transferred to a third party. It is easier for members to sell their share or leave their shares to their heirs with less paperwork and administration. There are instances when families set LLCs to hold family assets. This way, when one of the family members passes away, the assets are passed directly to the remaining members without the trouble brought by inheritance taxes. This gives the LLC perpetual existence since it continues to exist even after the original owners sell their shares or die.

Although LLCs do not deal with double taxation, they still incur pass-through taxes. This means that profits and losses are included on owner’s individual tax return, whether or not they receive dividends. Because of that, the LLC may be best suited to a one-person owner situation, since members may not appreciate pass-through taxes.

Members can’t rely on limited liability protection at all times. A process called “piercing the veil” comes into play when courts find members personally liable for fraud and illegal acts. As the areas where courts order the veil to be pierced continue to change and expand, it is difficult to predict in what instance the veil may be pierced.

Unless an LCC opts to be taxed as a corporation, the government considers it the same as partnerships and its members to be self-employed. This results in members personally settling their Social Security and Medicare taxes, collectively known as self-employment tax and are based on the business’ total net earnings. However, there are instances where members pay these self-employment taxes only on annual compensation and not the whole of the company’s pretax profits.

There are states that require the LLC to be dissolved if a member leaves the company, goes bankrupt or dies, and the remaining members to be responsible for remaining legal and financial obligations necessary to terminate the business. These members have to start a whole new LLC from scratch if they want to do business again.

It can be challenging to raise financial capital for an LLC because investors may be hesitant to put their money into an LLC. The limited growth potential can be attributed to the fact that LCC owners cannot issue shares of stock that may attract investors.

In most states, LLCs are required to pay a franchise tax or capital values tax. The payment ranges from a flat fee to an amount decided by the company’s revenue. There are also states which ask for high renewal fees or publication requirements.

Though the lack of strict requirements for governing the business can be an advantage, it can also mean problems down the road. It’s better to have a detailed operating agreement in place, which requires additional upfront costs such as attorney fees.

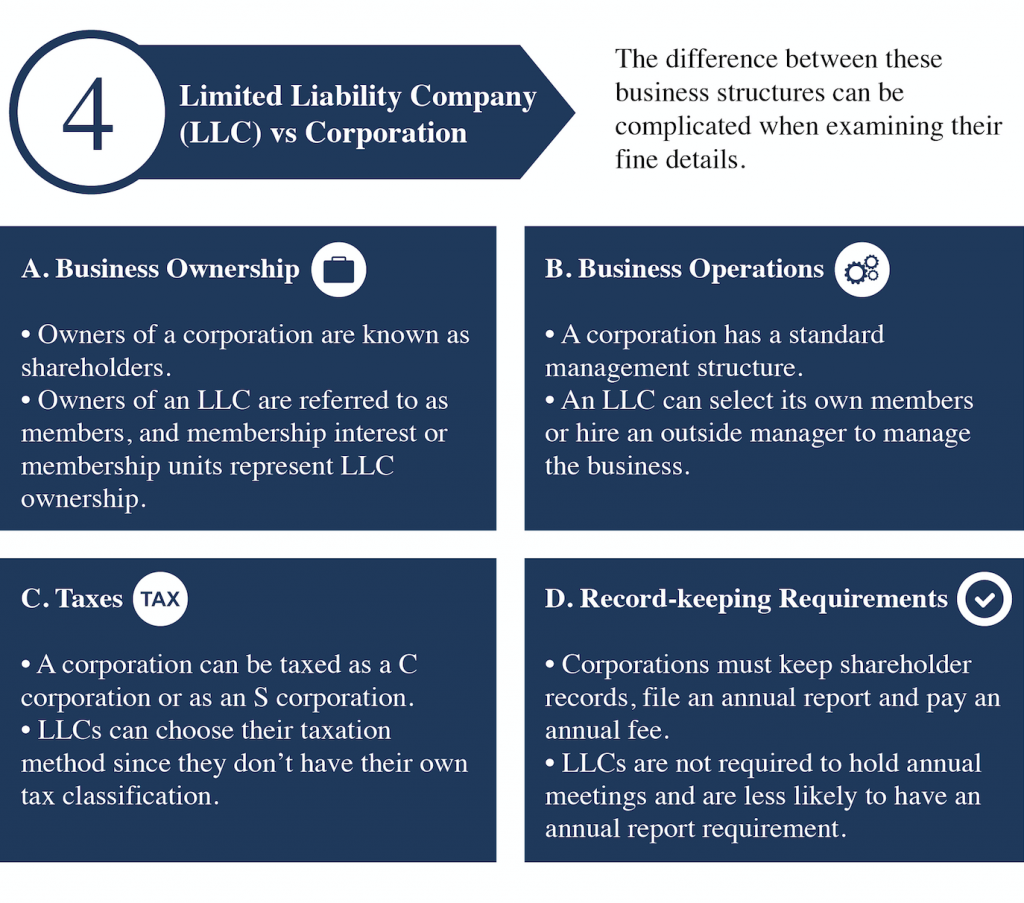

These two business structures have different terminologies when it comes to business ownership. Owners of a corporation are popularly known as shareholders. These shareholders own shares or stocks to represent their ownership. On the other hand, owners of an LLC are referred to as members, and membership interest or membership units represent LLC ownership.

A corporation has a standard management structure, which means that it must have a board of directors who handle management responsibilities, corporate officers who run the business day-to-day, and shareholders who own shares in the company. However, shareholders do not participate in business-making decisions except for approval of major corporate decisions. Shareholders receive business profits depending on how much and what type of shares they own. It’s rather easy for a corporation to add new shareholders or for shareholders to transfer their shares.

On another hand, an LLC has a more flexible management structure. It can select its own members or hire an outside manager to manage the business. Small member-managed LLCs could be informally run, and job titles are not important. While LLC members own certain percentage interest, profits are distributed in any way the members agreed upon. Additionally, LLC membership is not as easily transferred as corporate stocks.

LLCs and corporations are taxed differently. A corporation can be taxed as a C corporation or as an S corporation. A C corporation pays corporate income tax while an S corporation doesn’t. A C corporation is susceptible to double taxation as shareholders are required to pay personal income tax if they receive dividends. While in an S corporation, all the company’s profits pass through to the stakeholders who then pay their personal income tax. This “pass-through” taxation often saves money, however not all corporations can take advantage of it.

LLCs can choose their taxation method since they don’t have their own tax classification. By default, an LLC is considered a “pass-through” entity. However, it can opt to be taxed as a C corporation or an S corporation. Usually, a single-member LLC is taxed as a sole proprietorship, while multi-member LLCs are taxed as partnerships. Moreover, owners of an LLC pay self-employment tax with their income from the business.

Corporations have annual shareholders meetings, and they keep minutes of these meetings and records of important resolutions. Corporations comply with these requirements even if they only have one or two owners. Additionally, corporations must keep shareholders records, file an annual report and pay an annual fee.

On the other hand, most states require minimal requirements from LLCs. LLCs are not required to hold annual meetings and are less likely to have an annual report requirement. This is an attractive perk for small business owners who don’t want to deal with additional paperwork.

Now that you’ve made up your mind that you really want to form an LLC, here’s a breakdown of the process on how to start an LLC in Florida.

Do your due diligence and research for an appropriate and legal name for your LLC. Choose a unique name not just to comply with state requirements but more importantly to ensure brand recognition. Then go to the Florida state website and run a quick search to find out if your desired business name is available or not.

If your preferred business name is already in use, you will have to ask for consent from that business before you can use it. Your business name must contain “Limited Liability Company” or “L.L.C.” or “LLC”. You should also refrain from using language that may insinuate that your company is part of any local, state, or federal government entity.

Appointing a registered agent for your Florida LLC is a requirement. Your registered agent will act as a liaison officer for you and the state. Though Florida allows business owners to act as their own registered agents, it is still in your best interest to hire one. A registered agent may be a resident of Florida or a company that is authorized to represent a business in the state. They should agree to send and receive legal papers on your and your LLC’s behalf.

One of the requirements for you to register your LLC is to file the Articles of Organization with the state of Florida. When filing, you will need to decide whether the LLC is going to be member-managed or manager-managed. Filing for articles of organization in Florida is a breeze for many LLCs with the online filing service as well as in-person or by postal mail. Filing should be done with the Florida Division of Corporations. The form should include a cover letter that indicates the LLC’s name, applicant’s name, address, email, and contact information. Other documents included are:

Submit these documents and pay the filing fee which costs $125. You will receive an acknowledgment letter upon registration of your LLC.

The Employer Identification Number (EIN) is the federal government’s way of identifying a business entity. Think of it as your business’ social security number. An EIN is required when filing state and federal taxes. There are also instances when banks require an EIN to open a business checking account. Moreover, you are required to have an EIN if you are thinking of hiring employees and if your business has more than one member.

Figuring out the required licenses, permits and taxes of your Florida LLC is the final step of forming an LLC. Federal, state and local compliance requirements vary from business to business. You may have to exert more effort if the nature of your business requires you to get a couple of special permits and licenses.

An LLC Operating Agreement is the backbone of the limited liability company structure. It is a legal document outlining the ownership and member duties of the LLC. This governing document can regulate the LLC’s decision-making process. It also allows the owners to set out the financial and working relations among the LLC members.

This Operating Agreement includes every possible contingency to act as a protection to the business owners in different kinds of situation. This contract outlines what happens during the daily operations and on special circumstances detailing the process when a member leaves the LLC or passes. It also explains members duties and responsibilities for daily operations.

Simply put, an Operating Agreement helps members know the course of action to take and the things entitled to them. Additionally, it is the one responsible for the extreme flexibility of LLCs as each Operating Agreement differs depending on people and circumstances.

Though Florida law does not require an LLC to file an Operating Agreement, an LLC is required to comply with the rules established by the state in the absence of an Operating Agreement. Such rules are generic and cover a wide variety of cases. This makes them not tailored to a specific company’s needs and ultimately eliminating the flexibility of LLCs. Moreover, the law states that in the absence of a written form, the Operating Agreement should be implied orally or recorded in any medium. This can result in different interpretations between members which leads to misunderstandings and conflicts.

In Florida, LLCs are required to always be present to receive legal and tax documents. If the owner of the LLC cannot fulfill such requirement, they can designate an “agent” who provides such service and who is “registered” within the state. This brought life to the term “Registered Agent”. The LLC-designated registered agent will receive notices, correspondence, and other compliance-related documents on behalf of the company.

Eligibility for the said position is not that demanding. A registered agent must hold residence in the state where the LLC is registered where documents can be delivered. This means that a P.O. mailbox cannot be used.

If you do not reside or do not have a physical location in the state where your business is registered, then you need to have a registered agent to receive documents on your behalf. It is necessary for the state that it has a contact person for your business within the state at all times.

An LLC may opt to be its own registered agent granted that it maintains a physical address where it is formed. However, it is advisable to designate a third-party to carry out this important role. You must keep in mind that a registered agent should be available at all times to receive tax and legal documents. Having someone else as your registered agent can help ease your mind of worries because someone will always be available to claim important documents. It will also allow you to leave the office freely, take holidays, etc. without worrying you’ll miss any deliveries.

An LLC that does not designate a registered agent may be fined and lose their good standing with the state where they are registered. Failure to maintain a reliable registered agent may subject the company to potential penalties and fines. There is also the risk of not receiving important documents and other correspondence that may require a response. Moreover, if you’re not aware that you’re being sued, then you won’t be able to respond in a timely manner. This negligence can escalate and result in some serious damage in the future.

LLCs can have almost any type of owner which means members can range from individuals to corporations to foreign individuals and entities. Therefore, a non-resident of the United States is free to form an LLC under the laws of any state he chooses, and an entity based outside the country’s jurisdiction can form and own an LLC in the U.S.

Additionally, the LLC doesn’t have to be managed from within the U.S. or that its activities be conducted within the U.S. Simply put, a foreign individual can form and operate an LLC from wherever he chooses to be.

However, there are some restrictions of ownership on some foreign entities under various state laws other than citizenship or residency. For instance, state law may require that all members of an LLC engaged in the practice of law be licensed attorneys in that state. In addition, obtaining some requirements is more complicated if all members are non-resident individuals.

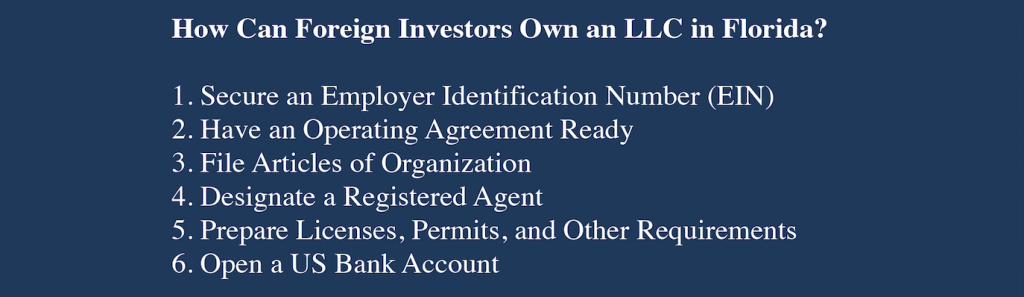

Since Florida attracts foreigners to live and invest in the state, there are a lot of foreign investors who chose to incorporate an LLC to transact business in Florida. While the process for opening an LLC for both residents and non-residents are somewhat alike, there are still a few differences. Here’s how a foreign investor can form an LLC in Florida.

In order to obtain an EIN or tax ID for the company, foreign investors must have a business name, a US business address, and information on the services and products offered by the business. It is recommended to have two alternative business name choices in case your preferred name is not available.

While Florida doesn’t require an LLC to have an Operating Agreement, it is advisable to have one drafted because it may be needed to open a corporate bank account. This legal document can also help define the rights and responsibilities of LLC members as well as outlines the organization’s operating terms.

To form an LLC, foreign investors need to file the Articles of Organization with the Florida Statutes. The Articles of Organization include the following:

Nominate a third party who is registered and residing in Florida. Your registered agent will receive and send official documents on your behalf. Such documents include service of process notices, official government notifications, tax forms, and legal notices.

Depending on the business type, you may be required to acquire certain licenses and permits. Additionally, to maintain good standing with the state, you must file an annual report and renew your registered agent’s service.

Though this is not a requirement, it is highly recommended to have a US bank account. Having a separate account for your personal funds from those of the LLC lessens the risk of creditors prying on your personal assets. While it is difficult to open a US bank account as an individual residing outside the US, it is quite easy for a US LLC to open a corporate US bank account.

Though it is a relatively new legal form for businesses, the LLC is certainly gaining popularity among business owners. However, the government is still looking at ways to tighten regulations concerning LLCs. That is why it is important to consult an attorney before deciding on jumping into this corporate structure.

The answer, like most things is “it depends”.

For simple situations, you can register your LLC yourself online. However, depending on if and how many partners you have in the LLC, if you are a non-citizen or another corporation who will be owning some or all of the LLC, you may want to get the assistance of a business lawyer to ensure all your bases are covered.

In addition to simply incorporating your LLC the Trembly Law Firm can: